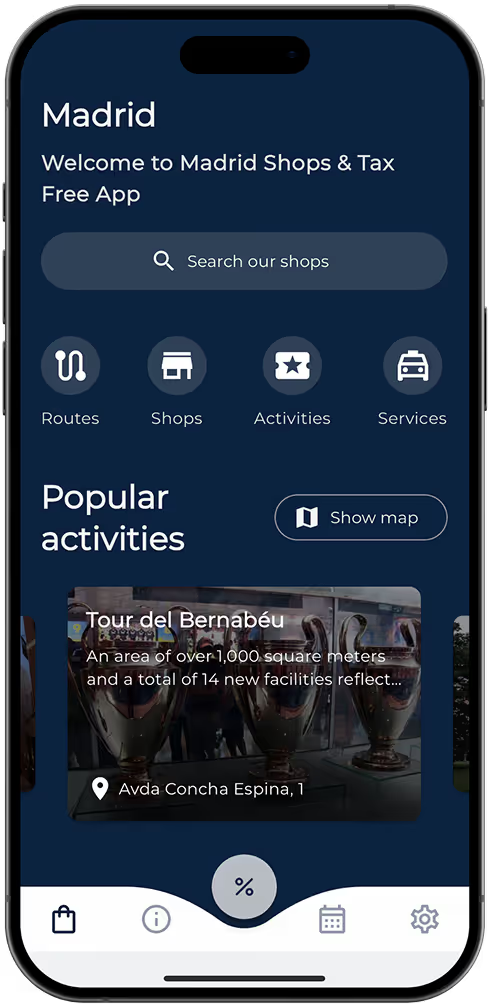

Tax Free

28/09/2021

Tax Free

In Madrid any tourist resident of any place outside the European Union will be able to enjoy the best Shopping Experience thanks to Tax Free. This system involves an additional reduce in the prices of the exportable products.

To purchase a product in Europe, you should pay the IVA (Value Added Tax) that is already included in the final price. All tourists outside of the European Union are entitled to reimburse this tax. In the case of Spain, this represents a reimbursement of 21% of the price of the product in the store.

¿How does the IVA (VAT) refund work?

First the store issues the visa with the corresponding VAT and the bar code for its digital seal. The word DIVA must appear in the code.

Then inside the airport can be found the DIVA digital sealing machines and place the Tax Free document under the barcode reader.

Finally, If it is approved, you can go to a return entity or to the merchant itself.

If it is denied, you must go to the customs staff for verification.

The list of authorised entities in Spain is the following:

-

Global Blue S.A.

-

Premier Tax Free (antes Cashback).

-

Innova Taxfree Spain (antes Spain Refund SL).

-

Caja de Ahorros y Pensiones de Barcelona.

-

Tax Free World Wide Spain S.L.

-

Open Refund S.L.

-

Comercia Global Payments Entidad de Pago S.L

-

Financiera El Corte Inglés, EFC, S.A.